Vietnam has rapidly become a go-to sourcing hub for wood furniture exports, especially for North American contractors, furniture brands, and retail chains. The country is not only a leader in volume but also a recognized player in manufacturing quality, sustainability, and pricing competitiveness. With growing interest from American businesses seeking alternatives to China, Vietnam has positioned itself as a reliable, cost-effective, and quality-assured supplier.

Table of Contents

1. Vietnam’s Rise as a Global Furniture Powerhouse

1.1 Overview of Vietnam’s Export Success

Vietnam is now ranked as the second-largest furniture exporter globally, trailing only behind China. According to Vietnam Plus, the country exported over $14 billion USD in wood and wood products in 2023 alone, with over 55% of this volume shipped directly to the United States. This staggering figure highlights not just Vietnam’s manufacturing scale, but its growing reputation among American importers seeking reliable wood furniture partners.

What makes Vietnam’s success more notable is the diversity of products exported: from kitchen cabinets and bedroom sets to knock-down (KD) and flat-pack furniture ideal for North American retailers.

1.2 The Question: Why Do U.S. Buyers Continue to Trust Vietnam?

Despite global supply chain challenges, labor cost increases in some regions, and shifting trade policies, U.S. businesses are expanding their partnerships with Vietnamese furniture exporters. Why? This blog explores seven key reasons behind that continued trust, backed by market data and real-world examples.

2. Seven Reasons Vietnam Became a Trusted Premium Furniture Supplier

Choosing the right sourcing country is a critical decision for contractors, retailers, and furniture brands in North America. Over the past decade, Vietnam wood furniture export has proven to deliver the right balance of cost, quality, and reliability. Below are seven key reasons why more U.S. companies are moving their supply chains to Vietnam and why Vietnam wood furniture export continues to outperform competitors like China.

2.1. Reason 1: Competitive Manufacturing Costs Without Compromising Quality

- Labor Savings: Vietnam’s average furniture labor cost runs 30–40 percent below China’s, directly lowering your vietnam wood furniture export landed cost.

- High Automation: Leading vietnam wood furniture export facilities invest in Homag, Biesse, and SCM CNC lines, achieving ±0.1 mm cutting tolerances and sub-2 percent defect rates.

- Business Impact: U.S. contractors report up to 25 percent total project savings when sourcing vietnam wood furniture export kitchen cabinets and case goods versus other markets.

Example: Flat-pack furniture exported from Vietnam arrives pre-drilled and precision-cut, helping U.S. contractors reduce installation times and labor costs on-site.

Learn more: Vietnam vs China Cabinet Manufacturers: A Comparative Analysis

2.2. Reason 2: Tariff & Trade Policy Advantages

Another strategic advantage of Vietnam wood furniture export is Vietnam’s favorable trade agreements, including:

- CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership)

- EVFTA (EU-Vietnam Free Trade Agreement)

These agreements allow Vietnamese manufacturers to offer lower tariff rates when exporting wooden furniture to the USA. By contrast, Chinese suppliers face higher tariffs and ongoing trade tensions.

Vietnam has also proactively reduced import duties on U.S. goods, fostering better two-way trade relations and encouraging long-term partnerships. This has made Vietnam wood furniture export more stable and cost-effective for American importers.

Learn more: US abolishes tax invasion investigation for Vietnamese wooden cabinets

2.3. Reason 3: Compliance with U.S. and Global Standards

In today’s regulated market, health and environmental compliance are non-negotiable. Top Vietnam wood furniture export factories meet the strictest U.S. and international certifications, including:

- CARB Phase 2: Required for formaldehyde emissions in California and many U.S. states.

- FSC: Ensures sustainable and legal wood sourcing.

- E1: Meets European formaldehyde emission limits for indoor safety.

- JIS: Verifies durability and material performance under Japanese Industrial Standards.

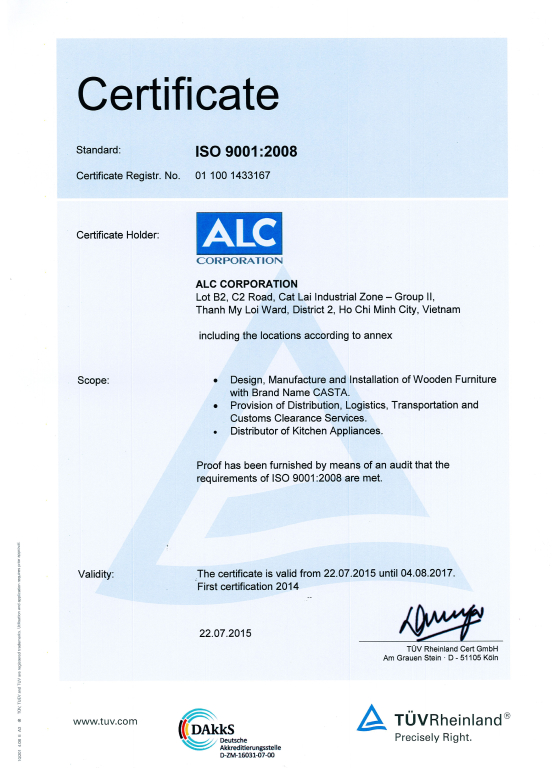

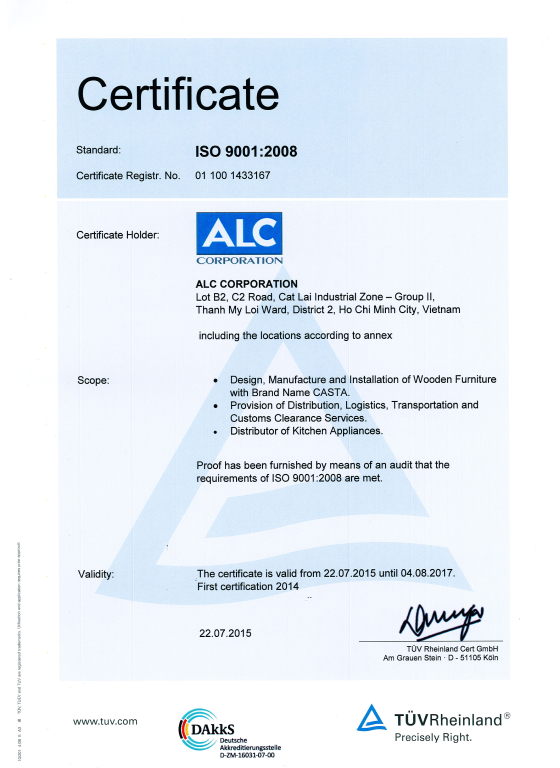

- ISO 9001 & ISO 14001: Guarantees quality management and environmental responsibility.

These certifications make Vietnam wood furniture export a trusted choice for brands and contractors who prioritize health-safe, sustainable products that meet both U.S. and global compliance requirements.

2.4. Reason 4: Strong Customization Capabilities

Unlike many high-volume suppliers that offer limited flexibility, Vietnam wood furniture export is known for strong customization tailored to brand-specific needs. Leading manufacturers provide:

- Bespoke design development, including door profiles, finishes, and hardware.

- Knock-Down (KD) and Flat-Pack solutions, ideal for U.S. retailers and e-commerce brands.

- 3 to 5 design iterations, allowing U.S. clients to fine-tune specifications before mass production.

This level of flexibility allows American brands to differentiate their product lines without taking on excessive MOQs, making Vietnam wood furniture export a smart choice for both large and boutique projects.

2.5. Reason 5: Advanced Technology and Automation

Vietnam’s furniture industry has evolved far beyond manual production. Today, Vietnam wood furniture export is powered by over 90% automated production lines that rival global leaders. Technologies include:

- CNC cutting and edge banding for precision fit and finish.

- Thermoforming and UV lacquering for moisture-resistant, high-end surfaces.

- Digital design platforms that enable quick prototyping and customer collaboration.

This tech-driven approach enables Vietnam wood furniture export to deliver premium craftsmanship at scale, making it attractive to both price-sensitive and design-conscious buyers.

2.6. Reason 6: Supply Chain Stability and Fast Shipping Routes

With its strategic location in Southeast Asia, Vietnam wood furniture export benefits from fast shipping routes to North America. Sea freight from Vietnam reaches U.S. West Coast ports in just 20–30 days, outperforming longer transit times from other Asian countries.

Vietnam’s rapidly improving logistics infrastructure—including deep-water ports and container-handling capacity—supports high-volume exports with consistent delivery schedules.

Example: Casta Cabinetry, one of Vietnam’s leading exporters, ships over 200 containers per month to the U.S., maintaining an on-time delivery rate above 98%. This reliability makes Vietnam wood furniture export a dependable supply chain partner.

Learn more: Lead Times & Supply Chain Resilience: Navigating Potential Disruptions

2.7. Reason 7: Government Support and Industry Resilience

Vietnam’s government plays an active role in supporting Vietnam wood furniture export through:

- Legal timber sourcing programs to ensure sustainability.

- Digital customs processes that speed up export clearance.

- Traceability systems that help U.S. buyers verify the origin and legality of materials.

These government-backed initiatives position Vietnam wood furniture export as a low-risk, high-compliance sourcing solution, especially compared to markets facing regulatory or political instability.

3. Casta Cabinetry: A Case Study in Vietnam’s Premium Manufacturing Capacity

When discussing the success of Vietnam wood furniture export, it’s impossible not to mention Casta Cabinetry. As one of the most advanced cabinet and furniture manufacturers in Vietnam, Casta stands as a benchmark for what U.S. contractors, furniture brands, and retailers can expect when partnering with a top-tier Vietnamese supplier.

3.1 Factory Overview & Production Capabilities

With two state-of-the-art manufacturing facilities covering over 100,000 m², Casta Cabinetry has built a reputation for delivering high-volume, precision-crafted wooden furniture to markets worldwide. Their operations exemplify how Vietnam wood furniture export has moved beyond low-cost labor to incorporate world-class production technologies.

Key Production Highlights:

- 90% Automated Production Lines: Casta utilizes a highly automated workflow that includes CNC cutting, edge banding, drilling, thermoforming, and UV finishing—ensuring consistency and speed without sacrificing quality.

- European Machinery Investment: Equipped with machinery from Homag, Biesse, and SCM, Casta’s production lines achieve precision tolerances under ±0.1 mm, meeting the strictest quality requirements demanded by U.S. buyers.

Learn more: Casta’s OEM Cabinet Manufacturer

- Flexible Product Range Tailored for Export Markets: Casta’s product portfolio is designed to serve the growing demand for Vietnam wood furniture export, including:

- Custom Cabinet Doors: Available in MDF, thermofoil, and solid wood.

- Ready-to-Assemble (RTA) Kitchen Cabinets: Engineered for flat-pack shipping to reduce freight costs.

- Flat-Pack Bathroom Vanities: Ideal for retail and online furniture sales.

- Commercial-Grade Furniture: Designed for large-scale housing projects, hotels, and multi-unit developments.

Learn more: Casta’s Ideal Custom Cabinets

This versatility makes Casta Cabinetry a preferred partner for U.S. contractors seeking high-capacity production, as well as for retailers looking for private-label ready furniture solutions.

3.2 Quality & Safety Certifications

What sets Casta apart in the Vietnam wood furniture export market is not just production scale, but compliance with international safety and sustainability standards. Casta provides full certification documentation with every shipment, ensuring smooth customs clearance and meeting U.S. regulatory requirements.

| Certification | Description | Benefit for U.S. Buyers |

| CARB Phase 2 | Formaldehyde emission compliance | Legally required for California and many U.S. states |

| FSC | Verified sustainable wood sourcing | Supports eco-conscious product positioning |

| E1 | European formaldehyde emission standard | Ensures low-VOC materials for safer indoor environments |

| JIS | Japanese Industrial Standard | Recognized worldwide for superior product durability |

| ISO 9001:2015 | Quality management certification | Guarantees consistent manufacturing processes |

| ISO 14001 | Environmental management system certification | Demonstrates responsible environmental manufacturing |

By providing these certifications, Casta strengthens its position as a trusted Vietnam wood furniture export supplier, giving U.S. buyers confidence in both product safety and sourcing transparency.

3.3 Customization & Client-Focused Design Process

One of the most valued strengths of Vietnam wood furniture export is design flexibility, and Casta excels in this area. Their client-focused design process supports both large-scale and small-batch custom projects.

Casta’s Customization Workflow Includes:

- 3 to 5 Collaborative Design Rounds: Clients can test, revise, and finalize product designs—ensuring dimensions, styles, finishes, and hardware fully align with their brand or project requirements.

- Extensive Finish Options: Casta offers a broad selection of finishes, including:

- Gloss

- Matte

- Embossed woodgrain

- High-Pressure Laminate (HPL)

- UV-coated surfaces

- Water-resistant treatments

- Knock-Down Packaging Expertise: Casta designs flat-pack solutions with detailed assembly instructions and optimized packaging, ideal for U.S. retailers and online sales platforms.

- Private Label & Branding Support: Casta provides custom labeling and branded packaging to support private-label programs for U.S. furniture brands and retail chains.

This flexible, end-to-end customization service is a key driver of Vietnam wood furniture export success, allowing American businesses to launch exclusive product lines quickly and confidently.

3.4 Logistics, Lead Time & Export Support

Casta’s experience in managing Vietnam wood furniture export logistics makes them one of the most reliable partners for North American buyers.

Key Export Capabilities:

- Average Lead Time: 30–45 days from order confirmation to U.S. port arrival.

- On-Time Delivery Rate: Over 98%, including for multi-SKU and complex orders.

- Flexible MOQs: Supports both container-load shipments and small-batch pilot runs, ideal for testing new designs in the U.S. market.

- End-to-End Export Support: Casta’s dedicated logistics team handles:

- Export documentation

- Freight coordination

- Customs paperwork

- After-sales service

These services ensure that U.S. buyers receive their shipments on time and without unexpected delays, reinforcing Vietnam’s reputation for stable wood furniture export logistics.

3.5 Why U.S. Buyers Choose Casta

For Contractors and Developers:

- High-volume production capacity supports large-scale residential or commercial projects.

- Pre-drilled, flat-pack cabinet systems reduce on-site labor costs and installation time.

- Certified materials meet U.S. health, safety, and environmental regulations.

For Retailers and Furniture Brands:

- Customizable designs and private-label services help build differentiated product lines.

- Scalable MOQs allow for market testing without overstocking risks.

- Reliable restock schedules ensure uninterrupted retail supply chains.

For Homeowners (Through Brand Partners and Retailers):

- Health-safe finishes for peace of mind in kitchens, bathrooms, and living spaces.

- Durable, easy-to-maintain surfaces suitable for everyday use.

- Affordable premium looks that balance cost, quality, and style.

Learn more: Casta’s Outstanding International Projects

In summary, Casta’s ability to deliver certified, customizable, and high-volume furniture solutions makes them a leading player in Vietnam wood furniture export—and a strategic partner for U.S. businesses seeking both value and reliability.

4. Detailed Comparison: Vietnam vs. China for Wooden Furniture Export

Choosing between Vietnam and China as your supply partner requires evaluating key operational, cost, and market factors. Here’s a detailed analysis comparing the two, based on common concerns raised by U.S. contractors, brands, and retailers looking to export wooden furniture to the USA.

| Feature | Vietnam Wood Furniture Export | China Wood Furniture Export |

| Labor Cost | Lower (30–40% less)Vietnam maintains highly competitive labor costs while investing in skilled production teams. This allows for lower unit pricing without sacrificing quality. | HigherRising wages and labor shortages in China have pushed production costs higher, impacting price competitiveness. |

| U.S. Tariff Risk | Lower Risk; Proactive NegotiationsVietnam benefits from trade agreements like CPTPP and EVFTA, minimizing tariff exposure and ensuring smoother U.S. market entry. | Higher Risk with Ongoing Trade TensionsU.S.-China tariffs remain unpredictable, posing cost and supply chain risks. |

| Certifications | Broad Coverage (CARB, FSC, E1, JIS Available)Vietnamese manufacturers offer a wide range of global certifications, meeting strict U.S. and European health and safety standards. | Limited to CARB, FSCMany Chinese factories meet basic U.S. requirements but fewer offer comprehensive international certifications. |

| Customization Support | Strong (Multiple Design Iterations Available)Vietnamese factories work closely with U.S. buyers to develop custom designs, finishes, and packaging for market differentiation. | Moderate (Bulk Production Focus)Chinese suppliers tend to prioritize high-volume, standardized production with limited design flexibility. |

| Production Scale | High with European AutomationVietnam’s top factories, like Casta Cabinetry, invest in automated European machinery, combining scale with precision. | Very High but Varied in QualityChina leads in sheer production volume, but quality can vary significantly between manufacturers. |

| Delivery to U.S. West Coast | 20–30 Days Transit TimeVietnam’s proximity and efficient shipping routes ensure quicker deliveries to North America, improving inventory planning. | 25–35 Days Transit TimeChina also offers fast shipping but may face longer port congestion times depending on the region. |

| Cost-to-Quality Ratio | Very HighVietnam offers a balance of competitive pricing and certified quality, making it ideal for U.S. buyers seeking long-term value. | Medium to HighChina offers good quality at scale but with higher costs and increasing regulatory risks. |

Summary Insights for U.S. Buyers

- Vietnam wood furniture export offers better cost-efficiency, lower tariff exposure, and more customization support—making it a strategic alternative to China.

- Chinese exports remain strong in volume but carry higher costs and regulatory uncertainty, which may not fit all U.S. buyer profiles.

By understanding these differences, contractors, brands, and retailers can make more informed sourcing decisions when looking to export wooden furniture to the USA.

Learn more: Success Stories: US Companies Thriving with Vietnamese Cabinet and Furniture Manufacturers

5. When Should U.S. Buyers Shift from China to Vietnam for Wood Furniture Export?

Deciding when to pivot your sourcing from China to Vietnam wood furniture export hinges on clear operational and market signals. Consider making the switch as soon as one or more of these thresholds are met:

- Tariff Threshold Crossed

- China Duties Exceed 25%: If anti-dumping or countervailing duties on Chinese wood furniture exports rise above 25 percent—eroding your margins—move to Vietnam wood furniture export where CPTPP/EVFTA rates hold at 0–4 percent.

- Compliance Breakdown

- Missing or Delayed Certificates: When your Chinese supplier struggles to deliver current CARB Phase 2, FSC Mix-Credit, or E1 documentation on time, shift to certified Vietnam wood furniture export partners who guarantee up-to-date credentials.

- Lead-Time Volatility

- Transit Spikes Above 50 Days: If average port-to-port shipping from China exceeds 50 days due to congestion or inspections, switch to vietnam wood furniture export routes that reliably deliver in 30–45 days to U.S. West Coast ports.

- MOQ Inflexibility

- 40 ft Container Minimums: When your Chinese factory enforces full-container MOQs that block private-label runs or market tests, pivot to Vietnam wood furniture export suppliers accepting 20 ft or smaller batch orders.

- Quality & Defect Rates Rise

- Rejects Over 3%: If your defect rate on arrival climbs above 3 percent—triggering reworks or callbacks—transition to Vietnam wood furniture export sources whose advanced CNC automation keeps defects under 2 percent.

- Green-Certification Demands

- Eco-Credential Requirements: When end clients or regulators require ESP, FSC, or KCMA-equivalent performance, adopt vietnam wood furniture export vendors whose standard process includes these certifications.

- Cost-Benefit Breakeven

- When Total Delivered Cost from Vietnam Beats China by ≥10%: Calculate landed cost—including tariffs, freight, and handling. Once Vietnam wood furniture export costs undercut China by at least 10 percent, execute the switch.

Key Action Steps:

- Audit your current China supply chain for duty costs, compliance gaps, and late shipments.

- Identify certified Vietnamese manufacturers specializing in Vietnam wood furniture export—verify CARB, FSC, E1, and KCMA-equivalent test reports.

- Order pre-production samples to validate material quality, CNC precision, and export-ready packaging.

- Plan a phased transition with a pilot order (20 ft container) before scaling to full production.

Learn more: Top rated cabinet manufacturers

By monitoring these indicators and taking a strategic, phased approach, U.S. buyers can confidently shift their Vietnam wood furniture export sourcing—unlocking cost savings, faster lead times, and consistent compliance.

6. Conclusion: A Strategic Export Partner for the U.S. Market

Vietnam has solidified its position as a leading wood furniture exporter, offering American contractors, brands, and retailers a competitive edge through cost-efficiency, customization, and certified quality. Manufacturers like Casta Cabinetry exemplify how Vietnamese suppliers can deliver on large-scale orders without compromising on design, safety, or reliability.

For businesses looking to export wooden furniture to the USA, Vietnam remains one of the smartest sourcing destinations in 2025 and beyond.

7. FAQ: Vietnam Wood Furniture Export

What materials are most commonly exported from Vietnam?

Are Vietnamese factories compliant with U.S. health regulations?

What is the typical lead time for export wooden furniture to the USA?

How can I verify if a Vietnamese factory is legitimate?

What are the risks with U.S. tariffs on Vietnamese furniture?

Top Cabinet Manufacturers in Florida: A Capability-Based Buy...

Cabinet manufacturers in Florida play a critical role in one of the fastest-growing construction markets in North Americ...

01/10/2026 | David Nguyen

Top North Carolina Cabinet Manufacturers | Best NC Kitchen ...

North Carolina cabinet manufacturers have long been trusted across the U.S. thanks to the state’s deep heritage in woodw...

01/08/2026 | David Nguyen

Top Cabinet Manufacturers in Arizona | Best Arizona Kitchen ...

Cabinet manufacturers in Arizona have gained increasing attention as construction activity accelerates across Phoenix, T...

01/06/2026 | David Nguyen

Top Cabinet Manufacturers Indiana | Best Indiana Kitchen Cab...

Cabinet manufacturers Indiana have become increasingly relevant as contractors and developers look for dependable Midwes...

01/04/2026 | David Nguyen

Contact us

Casta is always ready to listen and answer all customers' questions